All Categories

Featured

Table of Contents

In my opinion, Claims Paying Capacity of the carrier is where you base it. You can glance at the state guaranty fund if you desire to, yet bear in mind, the annuity mafia is enjoying.

They know that when they place their money in an annuity of any kind, the company is going to back up the claim, and the industry is overseeing that. Are annuities guaranteed?

Annuities Agent

If I put a referral in front of you, I'm also placing my license on the line. I'm really certain when I placed something in front of you when we speak on the phone. That does not indicate you have to take it.

We have the Claims Paying Capacity of the carrier, the state warranty fund, and my good friends, that are unidentified, that are circling with the annuity mafia. That's a factual answer of somebody who's been doing it for an extremely, very lengthy time, and that is that a person? Stan The Annuity Male.

Individuals normally buy annuities to have a retirement earnings or to build savings for one more objective. You can purchase an annuity from a qualified life insurance policy representative, insurance firm, monetary planner, or broker - highest annuity rates. You should speak with a monetary advisor about your requirements and objectives before you get an annuity

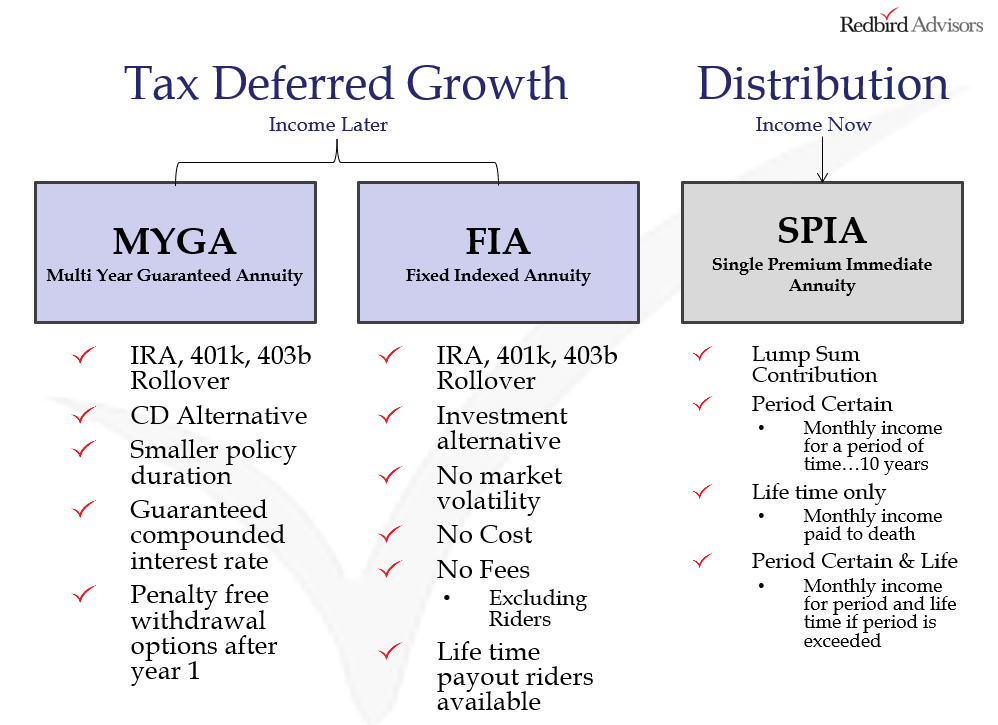

The difference between the 2 is when annuity payments begin. You don't have to pay tax obligations on your revenues, or payments if your annuity is a private retirement account (IRA), up until you withdraw the profits.

Deferred and instant annuities use a number of options you can select from. The options provide various levels of potential danger and return: are ensured to earn a minimum rate of interest rate.

How Do Variable Annuity Work

enable you to choose between sub accounts that resemble mutual funds. You can make much more, but there isn't a guaranteed return. Variable annuities are higher danger since there's a chance you might lose some or all of your cash. Set annuities aren't as dangerous as variable annuities due to the fact that the investment danger is with the insurer, not you.

Set annuities ensure a minimal rate of interest price, typically between 1% and 3%. The company might pay a higher passion rate than the guaranteed rate of interest price.

Index-linked annuities show gains or losses based upon returns in indexes. Index-linked annuities are more complicated than dealt with deferred annuities. It is essential that you recognize the features of the annuity you're taking into consideration and what they imply. The 2 legal functions that impact the amount of rate of interest credited to an index-linked annuity the most are the indexing method and the participation rate.

Each relies on the index term, which is when the business calculates the interest and debts it to your annuity (fixed annuity example). The determines just how much of the rise in the index will be made use of to compute the index-linked passion. Other important features of indexed annuities include: Some annuities cap the index-linked passion price

The floor is the minimal index-linked rate of interest you will gain. Not all annuities have a flooring. All taken care of annuities have a minimum guaranteed value. Some companies make use of the average of an index's worth rather than the worth of the index on a specified date. The index averaging may take place at any time during the regard to the annuity.

Other annuities pay compound interest during a term. Compound passion is interest made on the cash you conserved and the rate of interest you gain.

Immediateannuities Com

This portion might be utilized rather of or in addition to a participation rate. If you get all your money before completion of the term, some annuities won't credit the index-linked passion. Some annuities could credit just component of the passion. The percentage vested generally boosts as the term nears completion and is constantly 100% at the end of the term (annuities cash).

This is because you bear the investment danger as opposed to the insurer. Your representative or financial advisor can assist you determine whether a variable annuity is best for you. The Securities and Exchange Compensation categorizes variable annuities as safeties because the efficiency is originated from stocks, bonds, and various other investments.

Is An Ira An Annuity

An annuity agreement has 2 stages: a buildup stage and a payment phase. You have several choices on exactly how you add to an annuity, depending on the annuity you get: allow you to choose the time and quantity of the settlement. tax annuity.

permit you to make the very same payment at the exact same interval, either monthly, quarterly, or yearly. The Irs (INTERNAL REVENUE SERVICE) controls the taxes of annuities. The IRS allows you to postpone the tax on earnings until you withdraw them. If you withdraw your incomes before age 59, you will probably have to pay a 10% early withdrawal fine in enhancement to the taxes you owe on the rate of interest gained.

Calculate Annuity Rate Of Return

After the buildup stage ends, an annuity enters its payment phase. There are numerous choices for obtaining payments from your annuity: Your business pays you a repaired amount for the time specified in the contract.

Many annuities bill a charge if you take out cash before the payment stage - are annuities safe investments. This charge, called a surrender fee, is usually highest in the very early years of the annuity. The cost is commonly a portion of the taken out money, and normally begins at about 10% and goes down yearly until the abandonment period is over

Table of Contents

Latest Posts

Analyzing Strategic Retirement Planning Key Insights on Variable Annuities Vs Fixed Annuities Breaking Down the Basics of Fixed Income Annuity Vs Variable Annuity Advantages and Disadvantages of Index

Decoding How Investment Plans Work A Closer Look at Annuities Variable Vs Fixed Breaking Down the Basics of Investment Plans Benefits of Fixed Annuity Vs Equity-linked Variable Annuity Why Choosing th

Breaking Down Your Investment Choices Everything You Need to Know About Financial Strategies Defining Fixed Indexed Annuity Vs Market-variable Annuity Features of Smart Investment Choices Why Choosing

More

Latest Posts